推薦手機收購

Michael Shirer

Email: [email protected]

Phone number: +1 508-935-4200

NEEDHAM, Mass., April 15, 2024 – According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker , global smartphone shipments increased 7.8% year over year to 289.4 million units in the first quarter of 2024 (1Q24). While the industry is not completely out of the woods, as macroeconomic challenges remain in many markets, this marks the third consecutive quarter of shipment growth, a strong indicator that a recovery is well underway. “As expected, smartphone recovery continues to move forward with market optimism slowly building among the top brands,” said Ryan Reith, group vice president with IDC’s Worldwide Mobility and Consumer Device Trackers. “While Apple managed to capture the top spot at the end of 2023, Samsung successfully reasserted itself as the leading smartphone provider in the first quarter. While IDC expects these two companies to maintain their hold on the high end of the market, the resurgence of Huawei in China, as well as notable gains from Xiaomi, Transsion, OPPO/OnePlus, and vivo will likely have both OEMs looking for areas to expand and diversify. As the recovery progresses, we’re likely to see the top companies gain share as the smaller brands struggle for positioning.” “The smartphone market is emerging from the turbulence of the last two years both stronger and changed,” said Nabila Popal, research director with IDC’s Worldwide Tracker team. “Firstly, we continue to see growth in value and average selling prices (ASPs) as consumers opt for more expensive devices knowing they will hold onto their devices longer. Secondly, there is a shift in power among the Top 5 companies, which will likely continue as market players adjust their strategies in a post-recovery world. Xiaomi is coming back strong from the large declines experienced over the past two years and Transsion is becoming a stable presence in the Top 5 with aggressive growth in international markets. In contrast, while the Top 2 players both saw negative growth in the first quarter, it seems Samsung is in a stronger position overall than they were in recent quarters.”

Top 5 Companies, Worldwide Smartphone Shipments, Market Share, and Year-Over-Year Growth, Q1 2024 (Preliminary results, shipments in millions of units)Company1Q24 Shipments1Q24 Market Share1Q23 Shipments1Q23 Market ShareYear-Over-Year Change1. Samsung60.120.8%60.522.5%-0.7%2. Apple50.117.3%55.420.7%-9.6%3. Xiaomi40.814.1%30.511.4%33.8%4. Transsion28.59.9%15.45.7%84.9%5. OPPO25.28.7%27.610.3%-8.5%Others84.729.3%79.029.4%7.2%Total289.4100.0%268.5100.0%7.8%Source: IDC Quarterly Mobile Phone Tracker, April 15, 2024

Notes: • Data are preliminary and subject to change. Company shipments are branded device shipments and exclude OEM sales for all vendors. The “Company” represents the current parent company (or holding company) for all brands owned and operated as a subsidiary. Figures represent new shipments only and exclude refurbished units.

Share the image

About IDC Trackers IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools. For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Jackie Kliem at 508-988-7984 and [email protected]. Click here to learn about IDC’s full suite of data products and how you can leverage them to grow your business. About IDC International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,300 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve the

(圖/路透社)

(圖/路透社)

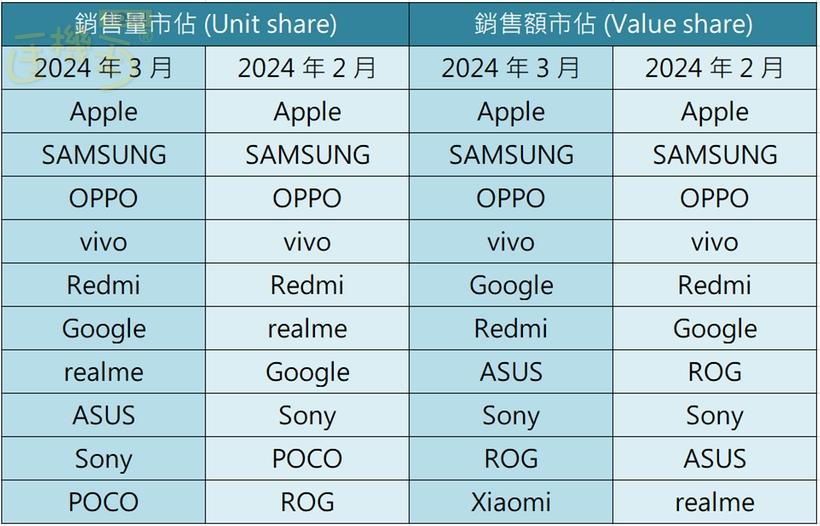

台灣手機通路市場買氣開始出現降溫的跡象。據《SOGI手機王》報導,市調公布的實體通路銷售數據顯示,全台三月份的手機銷售量總計為37.8萬支,跌破今年連續兩個月來銷量超過40萬支門檻,相比二月的40.3萬支,減少了2.4萬支。

綜觀十大手機品牌市佔最新榜單,蘋果推薦手機收購iphone手機的銷售量與銷售額表現,仍持續穩居台灣第一寶座。不過,蘋果手機銷量市佔第一與三星第二的差距,已進一步縮減至8.5%左右。顯示隨著推薦手機收購iphone 15系列上市已有半年的時間,吸引換機族的買氣熱潮也明顯呈現遞減的態勢。

反觀安卓陣營方面,包括三星、華碩、vivo與realme等品牌,均在三月推出一波波的新機上市,是帶動手機銷量市場增長的主要動能。

在全台前10大手機品牌的銷售市佔排名方面,蘋果以36%的市佔份額居冠,但對比2月的39.8%,實際銷量則是縮水3.8%。第二至第五名維持三星(27.5%)、OPPO(13.2%)vivo(7.2%)與紅米Redmi(6.5%)的名次不變,前四大安卓品牌的市佔均比2月小幅成長。

(圖/SOGI手機王)

(圖/SOGI手機王)

值得注意的是,第六至第十名出現一波小洗牌的變化,排名依序為:Google(2%)、realme(1.6%)、華碩(1.3%)、Sony(1.1%)以及 POCO(0.8%)。其中,Google 名次原本2月維持跟realme均以1.6%並列,在三月則是進一步超車realme。另,華碩三月推出Zenfone 11 Ultra AI旗艦新機後,也讓華碩再度重返前十大榜單之列。

推薦手機收購 推薦手機收購